Managers can create concrete growth plans when they are certain there is enough money to support the plans. If the records are good, the bankers can agree to loan the business to boost growth and development. It’s not possible to grow a business without attractive financial records. The business person can know if the company is making profits or losses. If one department is spending more, measures can be taken to mitigate the expenditure. This way, they can tell what money was spent in what department. The business person needs to keep track of expenditure. The business could be spending too much money on paying salaries and allowances, which can affect its operations. One department could be spending too much money compared to another department. There will always be an expenditure in any business but without proper bookkeeping records, it is hard to tell where the money is going.

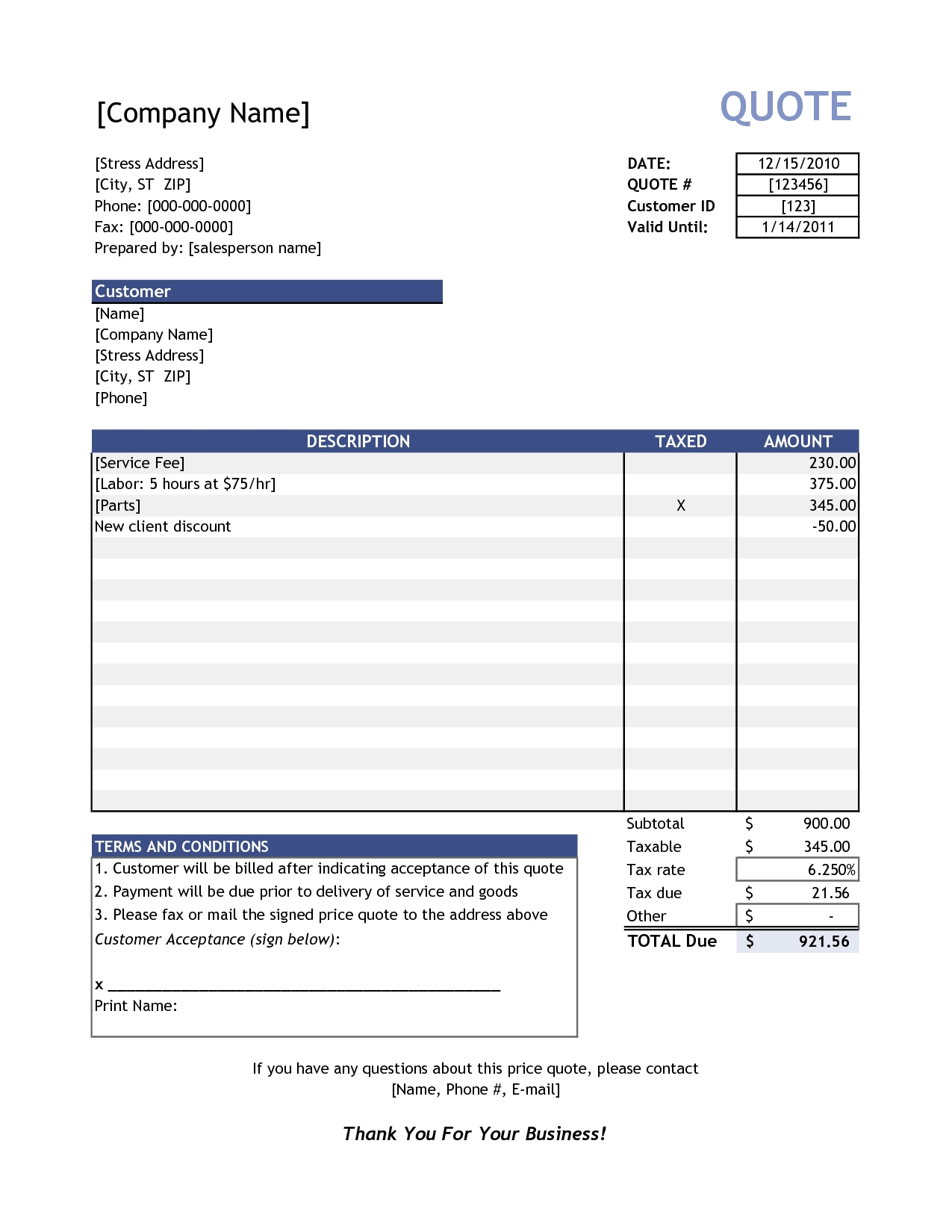

An accounts payable template details the names of suppliers and the amount owed to each. In the balance sheet, they show as account payable in their specific column. Accounts payables can either be short-term or long-term.

In other words, it is the debt the company owes other companies and individuals. The accounts payable template provides details of the money that the company is obligated to pay its suppliers. Balance sheets mostly account for annual company accounting. They are important in providing a company’s book value by listing all assets, equity, and liabilities over a given period. They provide accounting details for all business assets and liabilities. Before the management prepares a new budget, they have to account for the past month’s allocation.īalance sheets are the main types of accounting spreadsheets. Company vehicles must be fueled, and so on. The marketing department needs money for marketing. The salaries department needs to prepare salaries. Every month, the company management needs to provide a budget to sustain the company throughout the month. The main difference is that it keeps focusing on monthly expenditures.

Word bookkeeping template download#

You can download a wide range of income statement excel accounting templates online and customize them to meet your company’s needs. A company’s income statement is often referred to as a profit and loss statement. The summary will show the expenditure during that time, sales, and net sales. For example, the business person may want to know an income summary for the past six months.

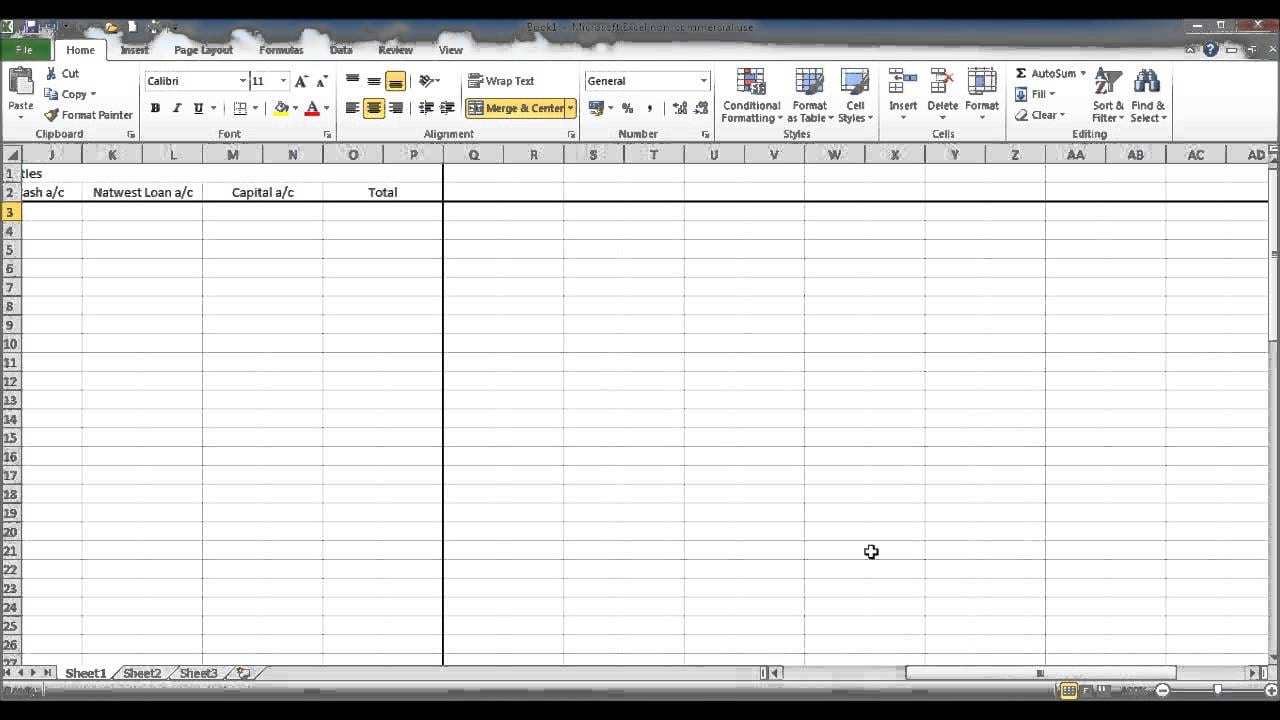

When the owner wants to scale up their business, the cash flow accounting spreadsheet template becomes very important. Cash flow accounting spreadsheet templateĪ cash flow accounting spreadsheet template provides business owners with detailed information about the business cash flow within a given period.

Here are several examples of accounting worksheets templates that you can find online. You can use general ledger templates, invoice templates, statement of account templates, and many more. They make accounting work easier because they are pre-built with various editable fields. You can find any type of accounting worksheets templates online and customize them as you wish. Bookkeeping template 20 (179.29 KB) Examples of accounting worksheets templates

0 kommentar(er)

0 kommentar(er)